Debasement and Opportunity

Europe has a chance to build monetary leadership in a shifting global order

This week, we explore a major shift in global finance through two complementary lenses. Marieke examines how stablecoins, Bitcoin, and gold are quietly reshaping the monetary system—creating what she calls an “Unofficial Bretton Woods” without coordination or permission.

Nicolas offers a counterpoint: while trust in institutions has eroded, a return to hard money constraints would limit growth and concentrate power in risky ways. The real challenge isn’t choosing between fiat and Bitcoin, but restoring trust in productive economies at a time when transparency is vanishing.

We agree on one crucial point: Europe must chart its own course through this upheaval, building financial infrastructure that serves its interests rather than following others into debasement. Read on 👇

💡 What caught Marieke’s attention recently

The bedrock of modern finance—trust in our institutions—is crumbling. From the bailouts of 2008 to the inflationary pressures of today, a crisis of confidence has fueled a demand for systemic change. The emerging mechanism? Stablecoins, which are quietly resurrecting the ancient concept of narrow banking. This movement, alongside a global pivot to physical and digital anchors like gold, Bitcoin, and energy, signals the start of an “Unofficial Bretton Woods,” radically reshaping the monetary map for the 21st century.

Are we witnessing a return to narrow banking, enabled by stablecoins? The renewed appetite for narrow banking—a model where banks limit activities to accepting deposits and investing solely in safe, liquid assets like government treasuries (sounding much like a stablecoin reserve)—is capturing my attention. This system stands in stark contrast to our current fractional-reserve model, which exposes the system to inherent risks.

A Short History of Trust and Banking: From Temples to Crypto

In their earliest and most primitive form, before central banks existed, banks were mostly vaults—secure places (such as temples) to safeguard hard earned and precious assets. The most primitive model of banking was the “Wild West” model: banks took deposits and lent part of them to others (and were robbed from time to time).

Once central banks appeared (around 17th century) , banks were given a new role—creating money—while the central bank kept them in check through policy rates (raising rates if lending grew too fast, cutting them if credit tightened) and reserve requirements (you can’t lend beyond a given ratio of reserves held at the central bank).

The mechanism was then effectively reversed: it was no longer “deposits create loans”, but “loans create deposits” (the money you lend to one client ends up being deposited by another).

The system continued to evolve, complexity increased, creating an intricate web of derivatives, collateralised debt obligations, and complex synthetic instruments. This recursive lending—creating money from money from money—worked brilliantly until 2008, when the system cracked.

The short version of what ensued: governments printed huge sums to bail out the banks, enriching insiders while central banks went full throttle on quantitative easing, which fuelled asset inflation. Banks were punished post-2008 with stricter rules (Dodd-Frank, Basel III, etc.) which led to a consolidation of the sector—fewer, bigger banks—and a pullback in lending, which helped private credit take off.

The result: rising inequality, political backlash, loss of trust in our institutions (banks, central banks, governments), the birth of Bitcoin as a solution allowing peer-to-peer money transfers without relying on third parties, followed by the broader crypto movement, embodying a mistrust in the system with mantras such as “code is law”, “trustless systems”, and “not your keys, not your coins.”

Fast forward to today: trust is (mostly) gone. People increasingly doubt the government’s ability to preserve the value of money (especially as US fiscal policy runs wild), there is a growing distrust of the central bank’s oversight, and we see the banks as too big to fail and too reckless to trust (Eric Trump’s recent intervention captures this sentiment).

The Bitcoin movement, which began as an experiment in 2008, has since grown and evolved into a significant industry. By 2025, it boasts over 580 million users globally, a market capitalisation exceeding $4 trillion, and stablecoin transaction volumes comparable to major international payment networks. This expansive growth, encompassing hundreds of different protocols and thousands of tokens, makes the industry impossible to ignore.

Stablecoins: The Catalyst for Change and Narrow Banking

Stablecoins are today often referred to as the ChatGPT of crypto, the Uber moment of money. What started a trader experiment to safeguard gains has ballooned in a giant and growing industry and a strategic tool to strengthen the dollar.

Beyond their spectacular growth stablecoins are also enabling the re-birth of “narrow banking”. Under the GENIUS Act, stablecoin issuers have to hold 1:1 the assets they issue on chain in 100% segregated highly liquid instruments such as cash and cash equivalent, creating in effect “narrow banks”.

Stablecoins allow individuals to utilise programmable money on decentralised finance (‘DeFi’) platforms to earn yields, bypassing traditional banking negotiations for lending and credit.

Paradoxically, as individuals shift from traditional finance to DeFi, trading USD stablecoins on DeFi platforms could effectively mean lending to the (broke) US Treasury, with Bitcoin potentially serving as a backstop.

Andrew Bailey’s recent opinion piece in the Financial Times, “The new stablecoin regime”, is a must read. In it, the Governor of the UK central banks argues that stablecoins could cut reliance on bank lending and rejig roles between central banks, banks and issuers. “It is possible, at least partially, to separate money from credit provision, with banks and stablecoins coexisting and non-banks carrying out more of the credit provision role.”

Building on this core argument Matt Levine’s Money Stuff newsletter and Izabella Kaminska’s recent article “Stablecoins as stablization programs for the West” both make very compelling arguments on how stablecoins enable narrow banking and thus promote stability.

The rise of stablecoins and crypto is not happening in isolation; it is part of a larger, global response to the erosion of trust in the established financial order. We are witnessing a Great Rebalancing, an uncoordinated ‘new Bretton Woods’ driven by three powerful, independent movements.

The Great Rebalancing: Three Movements Redefining Global Money

The last time such a crisis of confidence occurred—1944—it was solved by creating the Bretton Woods system, a managed gold-exchange standard that restored global monetary order. Today, in our fragmenting world no government has the agency or alignment to create a new Bretton Woods.

But we are witnessing a new Bretton Woods, except this time it’s not 140 delegates in a room, it’s hundreds of coders, protocols and individuals reshaping the system—asking no permission.

There are three movements which I’m closely following and seem to take place creating this rebalancing or debasement.

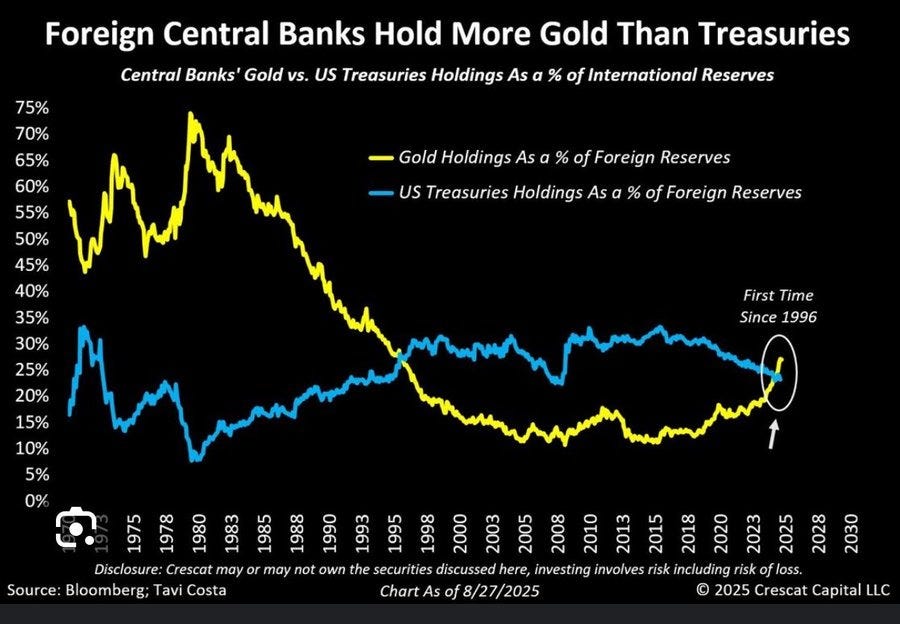

First, central banks are quietly hoarding gold like it’s 1944: For 3 consecutive years, global central bank gold purchases have consistently exceeded 1,000 tonnes annually—more than double the previous decade’s average.

Both China and Russia hold 2.3k tonnes of gold (60% of reserves), India’s reserves crossed $100 billion for the first time in October 2025 with 880 tonnes. Over 30 countries actively expanded gold reserves in 2024-2025.

Gold prices have exploded hitting $4,000 for the first time on October 8, 2025—marking the 45th all-time high of the year.

Second, more and more governments are talking about putting Bitcoin on their balance sheets.

The sovereign race for Bitcoin reserves is intensifying. The US established its Strategic Bitcoin Reserve on March 6, 2025, with 200,000 BTC from criminal seizures. The proposed BITCOIN Act aims to expand this to 1 million BTC over five years, with states like Arizona, Texas, and New Hampshire already enacting their own reserve laws.

Globally, the US leads with approximately 200,000 BTC, while China holds 190,000 BTC, though potential liquidation is a factor. Bhutan has quietly mined over 13,000 BTC since 2019, and El Salvador continues daily accumulation, surpassing 6,000 BTC.

Finally, energy emerges as the new anchor.

An increasing number of governments are exploring Bitcoin mining and holding, often drawing parallels to a store of energy.

Elon Musk’s recent tweet, “Bitcoin is energy,” garnered significant attention, echoing a sentiment that has been expressed for some time.

Bitcoin’s value is anchored in energy reality: you cannot fake the kilowatt-hours required to mine it. Miner’s incentive is to find the cheapest energy possible (else the business model does not work). This makes Bitcoin uniquely suited for our renewable energy future. Solar and wind create massive surpluses when we don’t need them and shortfalls when we do, while batteries remain prohibitively expensive for grid-scale storage. Bitcoin mining solves this by acting as a flexible demand sink that can shut off in 15 seconds (Texas miners already do this), helping stabilise the grid during peak demand while monetising excess renewable generation that would otherwise be wasted.

As Paolo Ardoino, CTO of Tether, recently wrote, it will be interesting to see where the competition for energy between Bitcoin and AI leads. Is it the ultimate equilibrium game theory?

In an era of infinite money printing and AI-generated everything, Bitcoin represents something that literally cannot be faked: proof of energy work. You can deepfake a voice, manipulate markets, or print trillions in currency, but you cannot shortcut the physics required to mine Bitcoin. As nations race to build AI infrastructure and print money to fund it, Bitcoin—backed by finite energy, finite supply (21 million), and finite computing power—becomes the ultimate hedge against debasement. It’s not digital gold. It’s digital energy, stored and ready to be deployed when needed most.

I don’t think the debate needs to be “gold” or “bitcoin” as the crypto community seems to be trying to frame things, or which asset will be worth more than the other – but rather what we should analyse is the move away from our existing system, and what seems to be a move away from a dollar based system. Nearly half of intra-BRICS trade is now settled outside the dollar, with China and Russia conducting most bilateral trade in yuan and rubles.

Europe’s Opportunity: From Defensive Rules to Programmable Money Leadership

If trust is eroding and asset allocation is moving away from the dollar, how can Europe position itself to seize this opportunity?

The US is leveraging stablecoins to extend dollar dominance, Asia is building alternative payment rails, meanwhile Europe remains defensively focused on rule-making and trying to prevent what is happening. To secure its role in the programmable economy, Europe must shift from defense strategy to leadership.

Europe’s approach to stablecoins, as evidenced by MiCA’s 30% segregation requirement versus GENIUS’s 100%, and the ECB’s development of both wholesale and retail Central Bank Digital Currencies (CBDCs), reveals Europe’s hesitation and fear. The decision to allow 70% of stablecoin reserves to remain unsegregated suggests a continued reliance on the traditional banking model, rather than embracing the inherent stability offered by narrow banking principles. And by pursuing both wholesale and retail CBDCs (with the digital Euro), the ECB inadvertently creates an environment of uncertainty and potential competition for innovators in the stablecoin industry.

We need decisive action and clarity to rebuild trust and create a competitive, future-proof money stack. Ideally this would leverage the ECB’ wholesale CBDC (not the digital Euro), tokenised deposits, and euro-denominated stablecoins. This strategic pivot would anchor Europe’s position in the programmable economy.

⚖️ What Nicolas makes of it

Marieke is right that trust has evaporated and that finance is re-anchoring itself around new forms of credibility. But I see a risk in confusing “anchoring” with “progress.” The rush toward hard money—whether in the form of gold, Bitcoin, or fully collateralised stablecoins—solves one problem while creating another: it freezes the capacity for growth.

1/ Why Countries Need Their Own Money

There’s a reason each country has its own currency. Monetary sovereignty is the foundation of economic sovereignty. A domestic currency allows policymakers to calibrate credit, inflation, and investment to national priorities. It keeps the feedback loop between productivity, wages, and money creation inside the same political community. Break that link, and you import someone else’s policy cycle.

2/ Credit, Not Collateral, Drives Growth

Lending isn’t simply recycling existing money; it creates new money. The central bank’s function—together with the commercial banking system—is to expand credit in line with productive potential. No modern economy has achieved sustained growth without that flexibility. Limit money creation to pre-existing reserves and you lock the economy into stasis.

3/ Hard Pegs Always Break

Every hard-money system eventually collapses under its own rigidity. The classical gold standard couldn’t keep pace with industrial expansion and cracked under deflationary pressure. The inter-war attempt to restore it, as Karl Polanyi analysed in his landmark The Great Transformation, produced mass unemployment and political extremism. Finally, Bretton Woods met the same fate when the US refused to adjust the dollar after Vietnam-era deficits. In some cases, pegs break not because of mismanagement but because productive economies outgrow their monetary corsets.

4/ Bitcoin Is a Deflationary Trap

Bitcoin hardwires that same problem in digital form. With a fixed supply of 21 million coins, it cannot expand with the economy. Rising productivity under a fixed monetary base produces permanent deflation, crushing borrowers and rewarding hoarding. As Michael Green notes (see his interview below), such systems create rentier classes living off past accumulation rather than production. That’s not a recipe for dynamism but for social rigidity.

5/ The Mirage of Narrow Banking

Narrow banking—holding 100 per cent reserves against deposits—sounds prudent, especially in a world that distrusts banks. But it moves money creation from a distributed credit network to the state itself. Rather than decentralisation, we end up with concentration! And if the “backing” is Bitcoin or Treasury bills, you’ve effectively subordinated the economy to whichever asset you choose. History suggests such arrangements last only until macro fundamentals diverge—ask Argentina.

6/ Private Credit Isn’t a Cure

The US shift toward private credit isn’t a model for Europe. Private credit is opaque, leveraged, and procyclical, as shown by the First Brands collapse. Germany and Japan built resilient growth by linking banks to productive industry, not by outsourcing credit to shadow markets. Financial architecture must reflect national industrial structures, not imported ideology.

7/ Fiat as the Credit of the State

Fiat money works because it’s backed by a nation’s productive capacity—the expectation that its citizens and institutions can generate, tax, and redistribute value. People trust the dollar because they trust America’s credit. Fiat collapses when that trust fails but can recover once credibility returns. Under a hard peg, recovery is impossible because the supply constraint itself becomes the crisis.

8/ The Information Problem

Since the 1980s, abundant data and open analysis have allowed markets to assess economic health and sustain confidence in fiat systems. However, that transparency is now fading. The Trump administration suppresses inconvenient statistics, firms delist, and private equity operates in near-total opacity. As the informational basis of trust erodes, the appeal of “objective” anchors like Bitcoin and gold grows—but this is a symptom of opacity, not a solution to it.

9/ Europe’s Task

On the conclusion, Marieke and I fully agree: Europe must chart its own course. But leadership doesn’t mean chasing digital pegs or copying US fiscal adventurism. It means building transparent, programmable financial rails that reinforce the euro’s credibility through openness and accountability. Europe should treat the current turmoil not as an excuse to shrink its monetary imagination, but as a chance to rebuild trust on its own terms.

Subscribe to Euro Stable Watch if you don’t want to miss the next issues 💶

Recommended in the euro stablecoin space:

ODDO BHF, First European Bank to Bring Stablecoin Reserves Onto Its Balance Sheet: “This model will become a reference” (Louis Tellier, Blockstories, 21 October 2025)

Stablecoins : « La rupture économique, ou idéologique, réside dans la privatisation possible de la monnaie » (Agnès Bénassy-Quéré et François Villeroy de Galhau, Le Monde, 19 October 2025)

Banque de France and Euroclear to tokenise short-term debt (Tahlia Kraefft, Securities Finance Times, 13 October 2025)

Keep reading with a 7-day free trial

Subscribe to Euro Stable Watch to keep reading this post and get 7 days of free access to the full post archives.