Tokenised Deposits: What the World Can Learn from the UK

The UK is forcing banks to modernise by putting deposits on blockchain rails

The stablecoin market has reached a tipping point, processing over $15.6 trillion annually, matching Visa’s entire global network volume. This digital infrastructure operates around the clock, yet Europe’s currency, the euro, remains a minor player, with dollar-pegged tokens dominating the now-$260 billion stablecoin market.

While global monetary authorities engage in intense debate over the optimal form of digital money—pitting Central Bank Digital Currencies (CBDCs) against private stablecoins—the United Kingdom is quietly charting a third path. And it’s very much worth our attention, as the UK’s emphasis on tokenised deposits may represent the most pragmatic and immediate model for deploying blockchain-based money within existing regulatory guardrails.

For industry professionals, regulators, investors, and policymakers, tracking this rapidly evolving landscape is crucial, as the decisions made now will determine Europe’s role in digital finance for the next decade. This edition of Euro Stable Watch analyses the UK’s unique strategy, positioning it not merely as an alternative, but as a potent forcing mechanism designed to push traditional commercial banks onto cryptographic rails.

The Global Landscape: A Tale of Diverging Strategies

The urgency of the UK’s approach is best understood when contrasted with the divergent strategies adopted by the world’s major economic blocs:

🇺🇸 America under Trump has explicitly rejected CBDCs, opting instead to back private stablecoin development to maintain dollar dominance in digital finance. Under the Trump administration, legislation like the GENIUS Act established clear frameworks for dollar stablecoin issuance, leveraging private sector innovation for global dollar adoption. This strategy is winning in terms of market adoption, with dollar-backed stablecoins commanding approximately 99% of the global market. The US approach centres on private sector innovation driving infrastructure control.

🇪🇺 The European Union has pursued a dual strategy, developing the world’s first comprehensive stablecoin regulatory framework through MiCA while also advancing an uncertain digital euro project, aiming to provide both a wholesale and a retail CBDC. This approach often causes policy paralysis and internal discord, with the European Central Bank (ECB) sometimes appearing hostile to private stablecoin initiatives. MiCA came first, but while it was being negotiated, little development occurred in Europe. Meanwhile, the US moved quickly, building its stablecoin ecosystem without waiting for a regulatory framework.

The result is structural disadvantages that prevent European firms from competing effectively with established dollar stablecoin networks. Euro-denominated stablecoins now account for less than 1% of the global market. Europe’s approach remains fundamentally regulatory first.

🇨🇳 China operates at the opposite extreme, pursuing the most aggressive state-controlled strategy. It aggressively pushes its digital yuan (e-CNY) as its primary tool for yuan internationalisation, with large transaction volumes in pilot programmes, and engages in cross-border CBDC initiatives like the mBridge project.

🇬🇧 The UK, which historically benefits from a preference for private initiative, is forging a distinct middle ground. It relies on its strong commercial banking sector to lead innovation, encouraging the use of tokenised deposits within the established regulatory framework. This is being piloted within the Bank of England’s regulatory sandbox, signalling a deliberate path of commercial bank-led transformation under close regulatory guardrails.

The Open Banking Parallel: A Proven Playbook for Innovation

The UK’s focus on tokenised deposits aligns with a successful playbook previously deployed to modernise its financial sector: Open Banking.

Open Banking originally originated at the EU level through the revised Payment Services Directive (PSD2) while the UK was still a member. Between 2015 and 2018, the UK went further, mandating Open Banking through the Competition and Markets Authority (CMA), forcing incumbent banks to open their APIs (Application Programming Interfaces) to third-party providers.

Initial resistance from banks was significant. However, this mandate spurred an innovation explosion, leading to a boom in the fintech ecosystem with the emergence of successful unicorns like Revolut, Monzo, and Starling. This structural change created new use cases, benefiting consumers and enhancing competition across the entire financial services market.

The UK’s tokenised deposit strategy parallels this history. Instead of mandating API openness, regulators are encouraging banks to put commercial money onto blockchain rails. This serves as a forcing mechanism to push innovation. Rather than adopting the reactive regulatory pattern often seen in Europe—regulating after American innovation defines the market—the UK is employing a proactive approach, forcing existing regulated institutions to adapt now.

This mandate encourages “learn by doing” rather than the risk-averse “wait and see” approach. By containing innovation within the existing commercial banking framework (Layer 2 of the money stack, as discussed below), the UK is building institutional blockchain competency safely. Large global banks, including JPMorgan, Citi, HSBC, and six of the UK’s largest financial institutions, are already responding by piloting or launching tokenised deposit services, demonstrating significant institutional momentum.

This approach addresses a critical need. Historically, European institutions have excelled at regulating yesterday’s threats while new innovations emerge elsewhere. The UK model attempts to break this cycle by forcing established, regulated players to future-proof their operations through mandatory participation in the development of tokenised money.

Tokenised Deposits Demystified

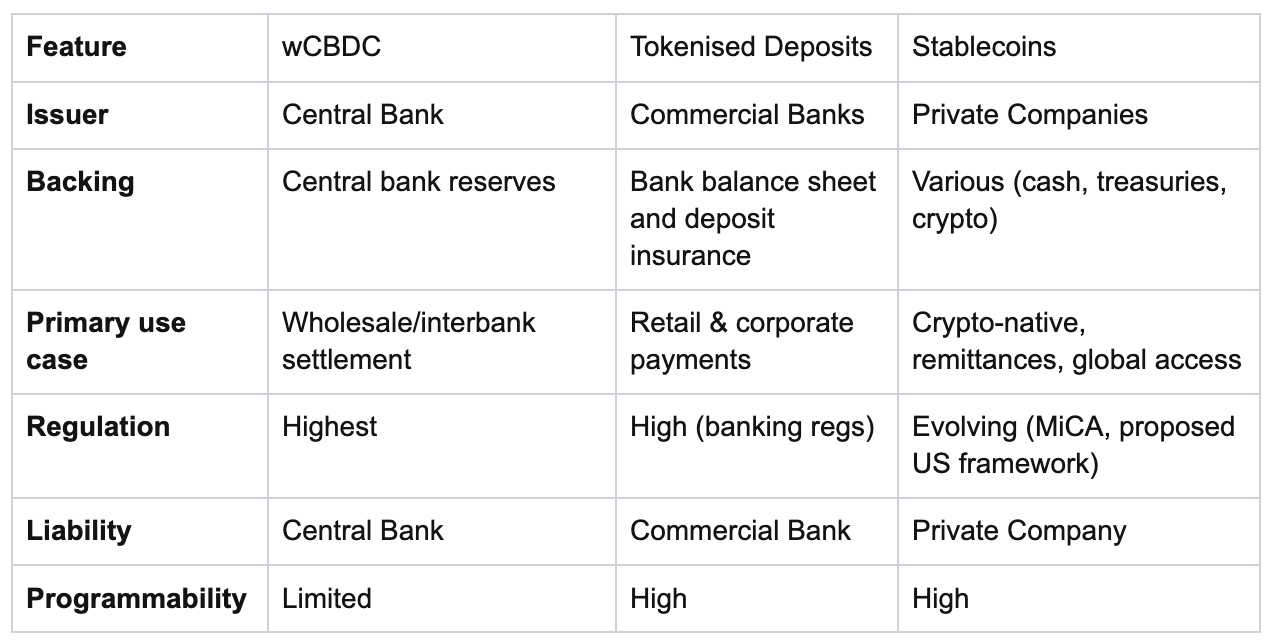

Tokenised deposits are commercial bank money represented as tokens on blockchain infrastructure. This instrument occupies a crucial intermediate space between cash-like CBDCs and private stablecoins.

Tokenised deposits give holders the same claim as traditional deposits, but exist digitally on a blockchain; just like traditional deposits, their security derives from the bank’s assets and regulatory capital requirements: tokenised deposits are regulated under existing banking laws, and remain covered by deposit insurance schemes. The legal relationship between the customer and the bank remains unchanged; the profound difference lies in the form of the money.

By placing deposits on-chain, money becomes instantly programmable:

Programmable Money: Deposits can be embedded in smart contracts to facilitate automated payments, conditional transfers, and advanced treasury management automation.

Atomic Settlement: Transfers occur 24/7, instantly and atomically, meaning settlement is final without multi-day delays or counterparty risk.

Composability: They can integrate seamlessly with other blockchain-based systems.

Major financial institutions are already deploying this model at scale, transforming the underlying architecture of commercial bank money. For example, JPMorgan’s JPM Coin processes over $1 billion in tokenised deposit transactions daily. As recently noted by Dr. Andreas Dombret, former member of the Deutsche Bundesbank’s Executive Board, “tokenised deposits allow regulated finance to internalise efficiency benefits and innovation without ceding monetary sovereignty,” highlighting how these digital deposits represent an adaptation of traditional banking to compete effectively with the digital conveniences offered by stablecoins.

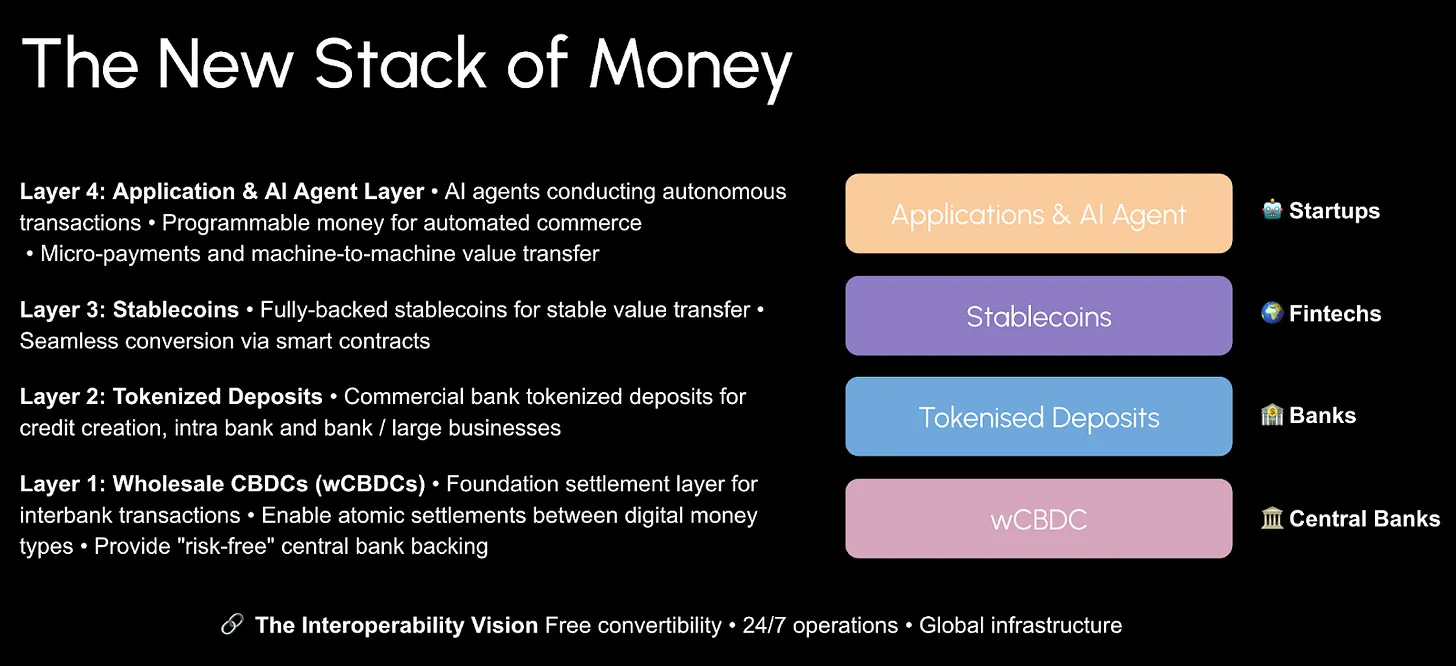

The New Stack of Money: How It All Fits Together

The rise of tokenised deposits confirms that the future of digital finance is not reliant on a single form of money, but a three-layer architecture where CBDCs, tokenised deposits, and stablecoins coexist and interoperate.

Layer 1: Wholesale CBDC (The Settlement Layer)

At the foundation of this stack sits the wholesale CBDC (wCBDC). This digital currency is issued directly by the central bank and used exclusively for interbank settlement and large-value transfers. It provides faster settlement, maintains central bank control over the monetary system, and offers the highest quality, most liquid form of money. For Europe, a wholesale euro CBDC is crucial, as it could provide the unified monetary infrastructure—a unified safe asset—that euro stablecoin issuers need, circumventing the fragmented sovereign debt markets that challenge euro stablecoin backing.

Layer 2: Tokenised Deposits (The Banking Layer)

Tokenised deposits sit atop the wholesale CBDC, functioning as the primary layer for everyday business and institutional transactions. This layer is where commercial banks transform traditional customer deposits into programmable tokens. Banks maintain their critical functions—credit creation, compliance, and customer relationships—but deliver these services using tokenised infrastructure. For a corporation, this means instant, 24/7 transfers and the ability to integrate treasury management with supply chain systems using smart contracts. Tokenised deposits are regulated bank money, providing confidence and regulatory clarity.

Layer 3: Stablecoins (The Public Internet Layer)

The top layer consists of stablecoins, which provide universal access to tokenised money without requiring a bank account. This is the “internet money” layer, which enables the global spread of a currency. Stablecoins, such as USD-denominated tokens that dominate the market, are crucial for remittances, financial inclusion in emerging markets, and integration with decentralised finance (DeFi) protocols.

The elegance of this new stack is its seamless flow of value: wCBDCs provide settlement finality, tokenised deposits offer programmable banking services, and stablecoins enable open internet access. All three layers are designed to coexist, rather than compete, serving different constituencies while preserving monetary control and enabling innovation.

SWIFT: The Incumbent’s Dilemma

The emergence of tokenised deposits and the new money stack fundamentally threatens the 50-year dominance of the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

Established in 1973 in the context of looming globalisation, SWIFT solved the chaotic problem of international payments by creating a standardised, secure messaging system. It connects over 11,000 financial institutions globally. Crucially, SWIFT does not move money; it moves messages about money. When an international payment is initiated, SWIFT sends a message (like MT103), and the actual value transfer follows later, over 1-5 days, through separate correspondent banking relationships. This model inherently involves a separation of message and money, reliance on multiple intermediaries, and counterparty risk during the multi-day settlement period.

Tokenised money undermines SWIFT’s core value proposition. In the new stack, the message is the money. When tokenised deposits are transferred, the transaction itself carries the value, and settlement is instant and atomic. This eliminates the need for correspondent banks, manual reconciliation, and multi-day settlement lags.

Every function SWIFT provides—payment messaging, correspondent banking, and multi-day settlement—becomes unnecessary. A tokenised transaction costs less than $1 and settles instantly, compared to the $25-50 cost and 1-3 day settlement of the traditional SWIFT model.

Recognising this threat, SWIFT is attempting a defensive strategy, notably through its partnership with Linea, Consensys’s Ethereum Layer 2 solution. This move is intended to position SWIFT as an interoperability layer between the various tokenisation platforms that banks might adopt.

However, the core question remains: Can a centralised messaging layer survive in a value-based, atomic settlement world? SWIFT is trying to preserve a message-based model when value transfers natively on blockchain infrastructure. Decentralised protocols like Chainlink CCIP and LayerZero are already building secure, open-source solutions for cross-chain interoperability, which could render any centralised connector obsolete.

SWIFT also faces immense organisational hurdles that echo the “Kodak invented digital camera” problem. Owned by over 11,000 member banks, its governance structure makes radical, rapid innovation nearly impossible. Correspondent banks, which profit from the slow, fee-heavy settlement process, have little incentive to support an instant, tokenised system that would destroy their revenue streams. Furthermore, SWIFT’s own revenue relies on message volume; enabling atomic settlement would reduce transaction volumes, forcing the co-operative to cannibalise its own business model.

SWIFT’s position is further complicated by geopolitical factors. The disconnection of Russian banks in 2022 demonstrated that SWIFT is fundamentally a tool of Western policy, undermining its perceived neutrality. In a world of rising geopolitical tension, decentralised, open-source protocols offer credible neutrality that centralised, bank-owned utilities cannot match.

The question is not whether SWIFT sees the future, but whether a 50-year-old co-operative can move fast enough to avoid gradual irrelevance in the face of new technology—especially because the new technology is decentralised, open source, and composable.

Conclusion: The UK’s Quiet Revolution

The UK’s strategic emphasis on tokenised deposits represents a strong middle path in the global digital currency race. By focusing on transforming existing, regulated commercial bank money, the UK ensures stability and compliance while driving institutional adoption of blockchain technology, helping to future-proof its domestic banking industry—a crucial objective given the British economy’s growing reliance on financial services over recent decades.

This approach offers the world a critical lesson: mandated participation is often necessary to achieve systemic change that overcomes the inertia of incumbents. Much like the Open Banking revolution, the tokenised deposit playbook compels banks to adapt, ensuring that the critical core of the financial system—commercial bank money—is prepared for the digital future.

Stablecoins remain relevant in the real economy when they meet the conditions necessary for public trust, as Bank of England’s Andrew Bailey has emphasised. Building on this principle, the UK is pursuing a dual strategy. First, it is leveraging a mandate to tokenise deposits to force its banking industry to upgrade, building institutional blockchain competency safely and future-proofing domestic banks. Second, it is designing these tokenised deposits to integrate seamlessly with the global stablecoin ecosystem, aiming to capture the benefits of cross-border digital finance. In effect, the UK is recreating the offshore finance network that gave rise to the eurodollar market in the 1960s, positioning London as a global hub for regulated digital money.

While the US pursues private stablecoins for dollar dominance and Europe grapples with MiCA constraints and CBDC uncertainty, the UK is defining a credible path that combines domestic stability with international reach. The world should watch closely; the architecture of the next-generation financial system is being established now.

Subscribe to Euro Stable Watch if you don’t want to miss the next issues 💶

Recommended in the euro stablecoin space:

(When) Will the digital euro be launched? (Alexander Bechtel and Jonas Gross, Frankfurter Allgemeine Zeitung, 7 October 2025)

EU must seize ‘unique opportunity’ to supplant US dollar dominance, says ECB president (Thomas Moller-Nielsen, Euractiv, 6 October 2025)

Crypto regulation tug-of-war divides EU (€) (David Whitehouse, The Banker, 6 October 2025)

Learning to Live with Crypto: Supervisory Dilemmas in a Dollarised Tokenised World (Dr. Andreas Dombret and Wessel Janse van Rensburg, Systemic Risk Centre, 2 October 2025)

Keep reading with a 7-day free trial

Subscribe to Euro Stable Watch to keep reading this post and get 7 days of free access to the full post archives.